News > Blog Article > The Safe Choice During Times of …

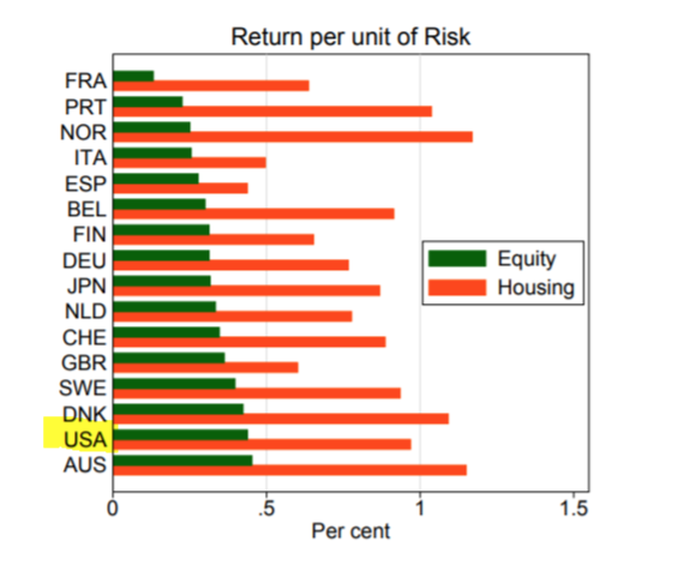

According to a study conducted by the Central Bank of San Francisco, the global residential real estate market has been the best long-term investment in modern history, having better returns than the stock market and with much less volatility and risk ("The Rate of Return on Everything ", 1870-1915, Federal Reserve Bank of San Francisco, 2017).

The study analyzed the returns of the stock market, bonds, sovereign bonds and real estate of 16 developed countries of the world between 1870 and 2015, becoming the most exhaustive study carried out to date.

In the long term, the residential market and the stock market had average returns close to 6%. However, the volatility of the average real estate market was 10% vs. 22% for the stock market.

On the other hand, the real estate market offered greater protection against inflation as the values of the real estate market tend to be more stable in both income and capital appreciation over time. In addition, there is a lower correlation of property prices between different countries, versus the stock market that is globalized.

In contrast, in the long term, the returns on sovereign bonds and investments considered very conservative have been between 1 and 3%, having negative returns in world wars and offering little protection against inflation and periods of low growth.

These results challenge the traditional belief that higher profitability is always associated with greater risk and redefines long-term investment strategies.

Investing carries risks, including loss of capital and illiquidity. Please read our Risk Warning before investing.