News > Blog Article > How does Real Estate Crowdfunding work …

With Real Estate Crowdfunding experiencing an estimated 150% increase in 2015, it’s clear that developers and investors alike are beginning to see the benefits of an equity Crowdfunding approach to property investment. More growth is predicted for 2016, and Forbes have recently suggested that equity Crowdfunding will soon overtake traditional venture-capitalist investment in the coming years; indeed, 2015 saw the two forms of investment come very close to a level playing field in terms of funds raised.

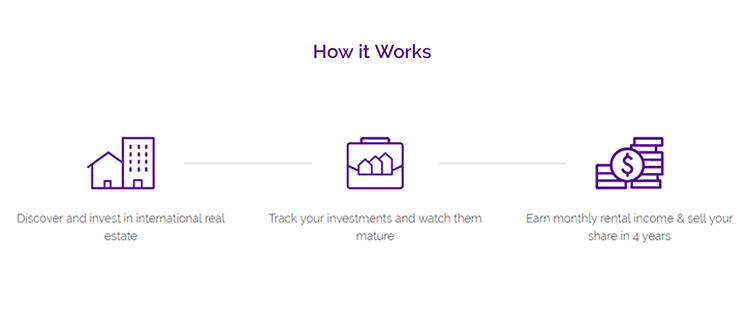

All of this expansion will bring in a new wave of potential investors. But they will need to know how it all works, so here is a run-down of how Bricksave operates and what the full process entails.

Bricksave begin by sourcing high-end properties in the some of the world’s most desirable cities, teaming up with established developers and institutional partners to ensure that the property already has a secure long-term tenant, therefore ensuring rental returns from day one. This low-risk approach is what makes Bricksave different from many other Real Estate Crowdfunding platforms that focus mainly on investment in high-risk, fix and flip properties, which are subject to both fluctuating interest rates and the success or failure of the property’s development as a whole.

After a careful curation process, Bricksave then select the properties that have the highest potential value as investment opportunities, and then advertise each property on their website, complete with all necessary details that investors will need in order to make a decision. At the same time Bricksave organise all of the necessary paperwork and put in place all of the necessary legal procedures for each property. After setting up a Bricksave account, investors can then collectively buy a property through online investments, with payments starting from as little as $2,500. Once a property is fully funded and subsequently bought, the investors then receive a proportional share of the rental income straight into their Bricksave account, as well as a share of the returns once the property is sold four years later. Everything is done online via the Bricksave website, meaning that the process is hassle-free and you don’t have to do anything.

The aim of Bricksave is to open up real estate opportunities to a whole new market of potential property owners, those that may not have had access to the real estate sector previously because of the extortionate amount of capital needed to invest in the traditional manner. We do not see Crowdfunding as being just a way for existing real estate brokers to evolve their business online, but rather as a way to open safe, secure, transparent opportunities to the masses. Crowdfunding with Bricksave also gives investors access to properties in locations that were previously inaccessible even to those with relatively large amounts of capital, due to the desirability and upscale nature of the cities and properties that Bricksave choose.

Written by Bricksave CEO, Tom de Lucy

Investing carries risks, including loss of capital and illiquidity. Please read our Risk Warning before investing.