By Bricksave Admin | Bricksave

July 28, 2022

News > Blog Article > House prices and the fundamental value …

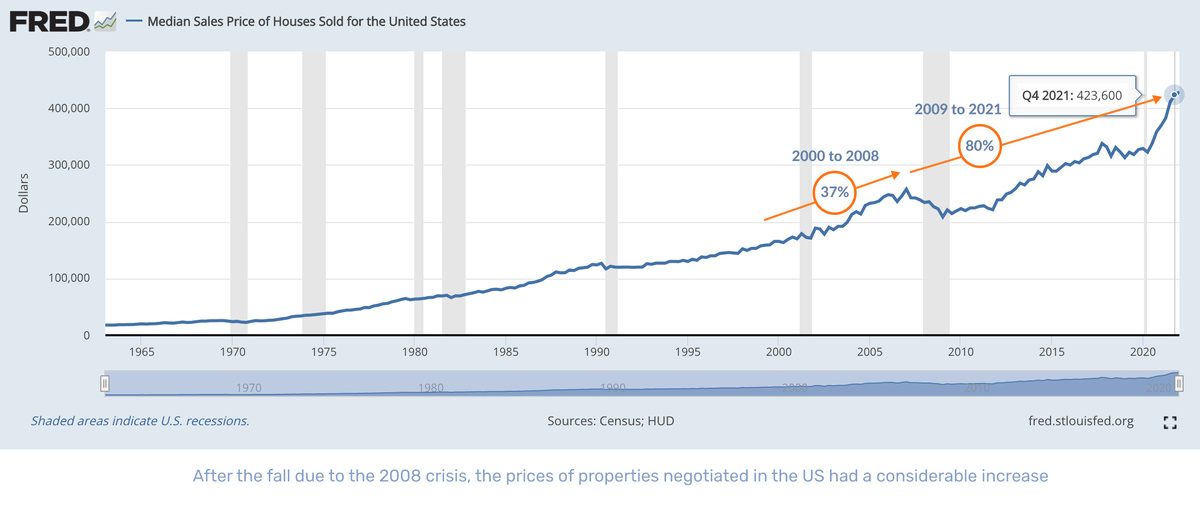

House prices in the US keep rising. Driven by limited housing stock and intense competition, house prices in the US have been increasing consistently year-on-year since 2012, regardless of the health of the rest of the economy. And, unlike most other sectors that saw a significant slowdown in activity, the US real estate market has defied all expectations to reach record highs in the post-pandemic period.

Since mid-2020, US real estate prices have seen double-digit surges in price, peaking above 19% in June and July 2021, and February 2022. By some estimates, house price growth has now reached a 45-year high. This is a remarkable statistic considering the disruption plaguing the rest of the economy.

The story of consistent price growth in real estate is a far cry from the performance of other investments and assets. From cryptocurrencies to equities and fixed-income investments, inflation and interest rise impacted many investors’ returns. Despite the challenges the rest of the economy has been facing, US real estate continues to be one of the most consistently solid asset classes to invest in. But why do house prices continue to rise?

Real estate prices rise and fall due to a range of different factors, some more short-term, others more long-term. When prices rise over time, this is called price appreciation. Among the many factors driving long-term appreciation, low-interest rates have been one of the key ones. Low-interest rates make it cheaper to borrow money, and lead to more money in the economy. This typically makes mortgages more affordable for many buyers, fueling an active housing market. In such an active market, prices rise as sellers receive more offers and try to get the best deal. And in an environment where governments have printed plenty of stimulus money, there is a lot of demand for real estate.

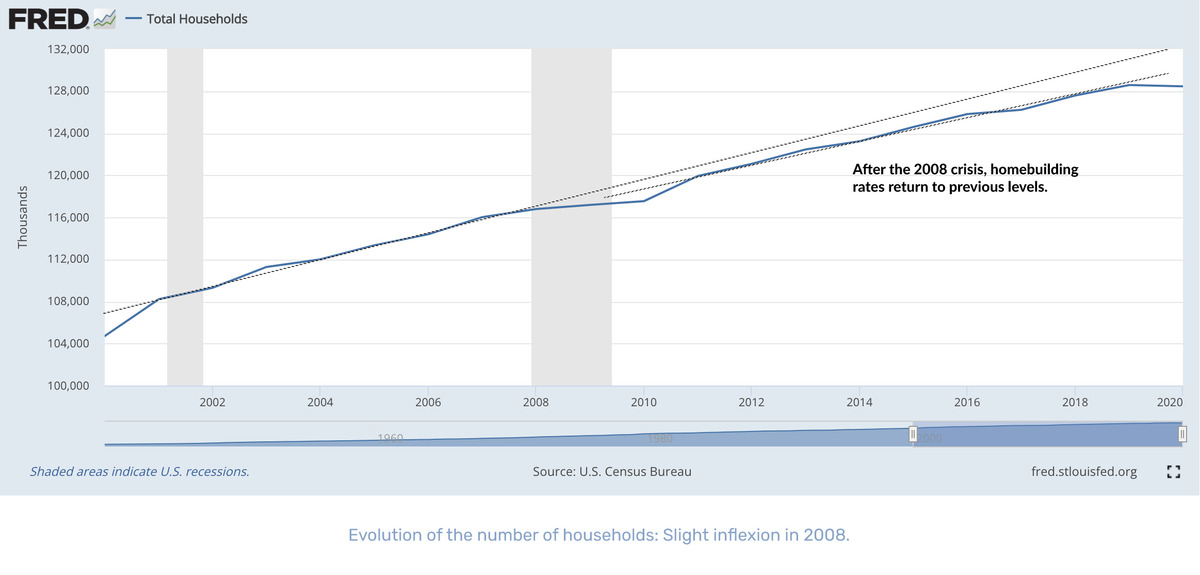

However, the story of constant property price rises has to be put into a longer-term context. In countries such as the US, the single-biggest factor leading to price appreciation is the lack of affordable housing. Demand for housing is much greater than the amount available. With so many buyers bidding for houses, prices quickly spiral. While short-term factors have certainly led to a post-pandemic price surge, the longer-term picture is of a more fundamental imbalance of supply and demand in housing.

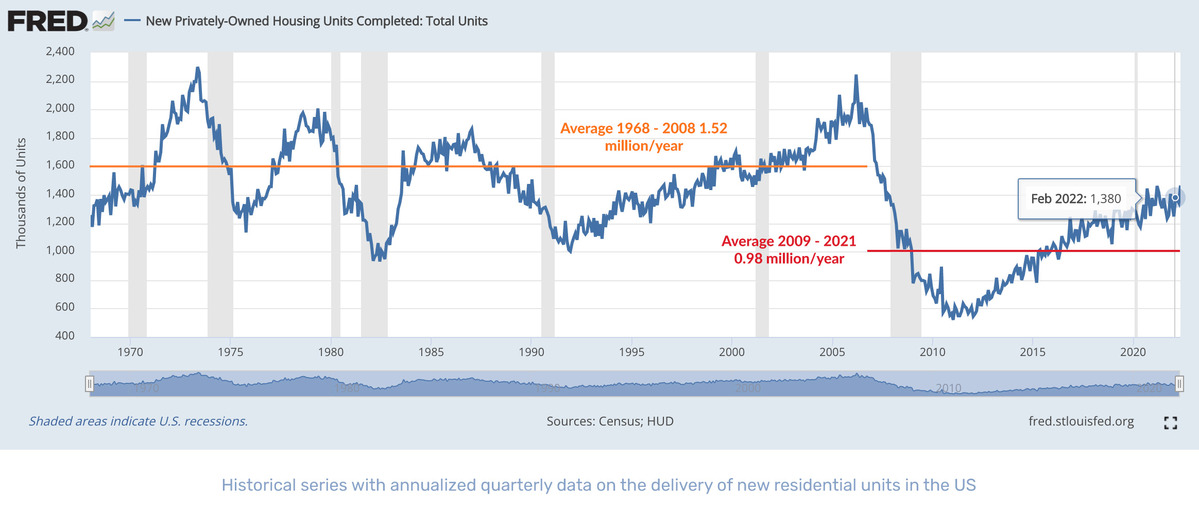

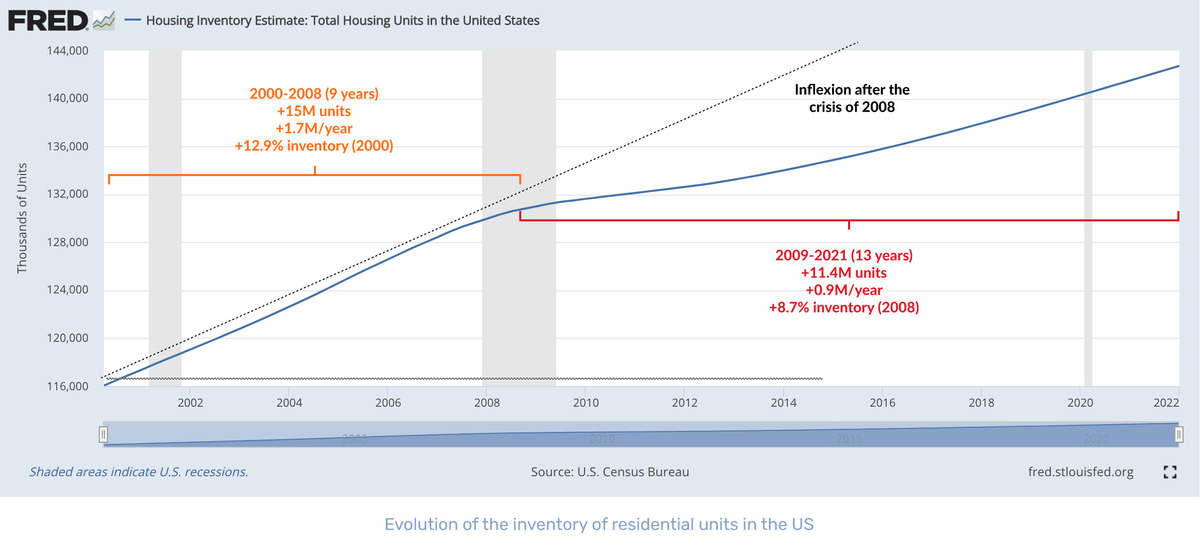

But it hasn’t always been this way. At different stages in US history, there have been expansions and contractions in the supply of housing. In the years leading up to the 2008 subprime mortgage crash, the average annual construction of new houses was around 1.52 million, going some way to alleviate the demand for housing. But when the property market crashed, many construction firms went bankrupt, leading to a sharp drop in the production of affordable housing.

While the crash happened over a decade ago, the real estate market continues to bear the scars. Many previous homeowners haven’t taken out new mortgages, some people are still reluctant to take the risk of getting a mortgage, and construction firms are more selective about the kinds of houses they build. This has led to more expensive housing being built rather than affordable housing. Today, annual average property construction remains substantially lower than pre-2008, at around 980,000 units.

The 2008 crash continues to shape the modern real estate industry, with the long-term effect of less housing construction playing a pivotal role in the current housing price surge. The imbalance between supply and demand of housing continues to be felt in four key ways:

Although the pandemic period has sparked a major increase in prices in the housing market, it might not last. High inflation has forced the Federal Reserve to raise interest rates, creating an immediate impact on household disposable income. This will likely lead to fewer people looking to take out mortgages and a slowdown in house price increases.

But a slowdown in price increases is still a price increase. Government-backed mortgage company, Fannie Mae, still expects prices to grow substantially over 2022 before a slowdown begins in 2023. And prices are still expected to grow by around 3.2% next year, however, proving that the underlying fundamentals of the US housing market are sound.

Whatever the future holds for the US economy, demand for US real estate remains strong and is expected to drive steady, long-term returns for investors.

At Bricksave, we give people the opportunity to invest in global real estate for as little as $1000. It only takes a few minutes to invest in a property and to start seeing the long-term rewards of your investment, whatever is happening elsewhere in the economy. Find out more about investing with Bricksave today.

Investing carries risks, including loss of capital and illiquidity. Please read our Risk Warning before investing.