News > Blog Article > What to Expect from Investing in …

As the New Year truly gets underway it is always a good time to look back on the previous year, and sometimes more importantly, to look ahead at the coming year. Whilst here at Bricksave we have had a record year, posting higher than forecast returns for our crowdfunders and expanding our properties offering, we also wanted to take a moment to share our thoughts on the global economic prospects for the year ahead.

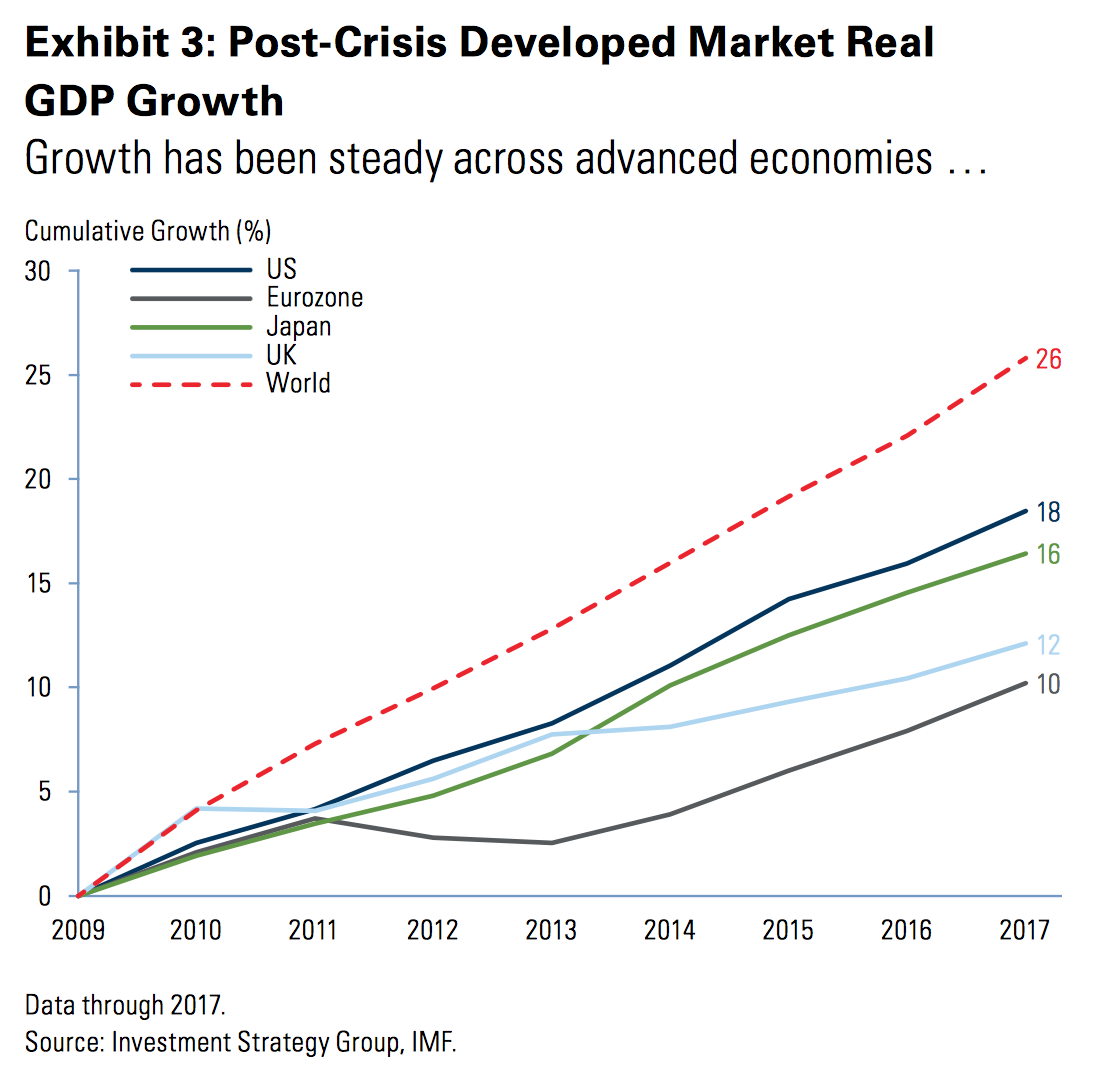

During 2017 US economy continued to grow, making this recovery the third-longest in the post-WWII era, and the second-longest recovery since 1945.

The International Monetary Funds World Economic Outlook forecast showed 179 of 192 posting economic growth last year, and the IMF forecasts 2018 will have the fewest countries in recession ever. This trend of growth is further supported as global unemployment rates have declined in 2017, with 2.1 million jobs created in the US and a total of about 8.2 million newly employed people in the member countries of the Organisation for Economic Co-operation and Development (OECD)

There are great opportunities for strong, low risk earnings to be had in some of the worlds strongest currencies and stable geographies, especially when people want to avoid risk. Although on the long run, these countries are far better off than the developing world, equity markets are subject to big drops and the expected interest rates could be raised to adjust some variables. In these cases, unleveraged real estate in investment grade countries tends to be an excellent opportunity for any investor.

Whatever your thoughts are on Mr. Trump's presidency and its global effects, the long term strength of the dollar and euro cannot be denied and we see no reason why this trend should not continue. With institutional investors and High Net Worth individuals from emerging markets looking to seek security against local inflation and the high risk of internally issued government bonds now is as good a time as any for investors to consider options that allow them to hold assets in the worlds strongest currencies as a long term bet.

Investing carries risks, including loss of capital and illiquidity. Please read our Risk Warning before investing.