By Bricksave Admin | Bricksave

September 29, 2022

News > Blog Article > Real Estate Crowdfunding - steady, reliable …

Why do we invest? The answer is simple – to make money. You might be saving for your children’s education, your retirement or for that dream car, but making money is the bottom line.

Whilst some investors have got rich quick by buying into the right opportunity at the right time and then getting out at the right time if growing an investment portfolio over time is your objective then slow and steady wins the race.

High volume, short-duration investments that can generate fantastic returns very quickly, such as day trading, are certainly exciting, but unless you really know what you’re doing it can be a very risky strategy. Most investors will have a better chance of achieving their goals by investing regularly and investing in less volatile assets.

If time is not an issue, non-professional investors should build their investment portfolio around low-volatility assets, be prepared to hold those assets for the mid-to-long term, and watch their core holdings steadily appreciate in value.

Slow, steady investment assets will very likely lag behind riskier investments during the good times, but they will nonetheless follow the rising trend. When the economic environment changes, riskier investments will almost certainly tumble further than a slow, steady asset such as real estate.

Real estate crowdfunding, done correctly, is a great option to invest in reliable assets with strong yields and low levels of volatility. Because you have the option to commit much less of your capital to otherwise extremely expensive assets, crowdfunding reduces your exposure to risk even further.

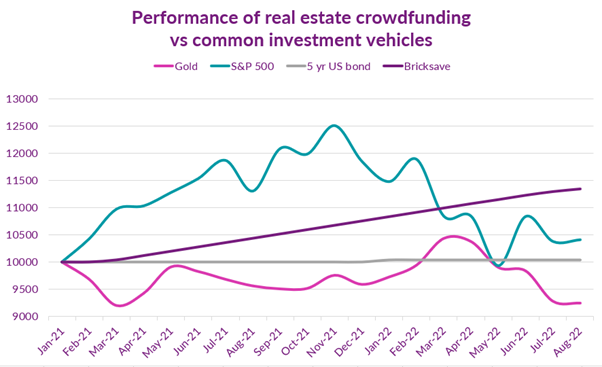

To illustrate, the chart below compares the performance of $10,000 invested into one of Bricksave’s crowdfunded properties – 9317 Ward St, Detroit – to a selection of other popular investment classes over the same period:

As can be seen, significant recent events - namely the Covid recovery, the cost-of-living crisis and the war in Ukraine – have created very uncertain economic conditions to which asset classes have responded differently:

A $10,000 investment into a Bricksave property in January ‘21 would currently be worth around $11,340, has provided consistent, reliable returns of around 9% per annum, paid on a monthly basis to investors. There is also the possibility of further profit from capital growth when the property is sold in January 2025.

Over the same period, the S&P500 could have turned $10,000 into just over $12,500 provided you’d sold at the very top of the market…or $10,500 if you were still holding your investment today. The volatility risk of stocks is plain to see.

$10,000 invested into gold in March ’19 would now be worth approximately $9,250 with some ups and downs along the way, peaking at $10,500 in March ’22.

Finally, a U.S. government-issued 5-year bond would today be worth just $10,042 – that’s a mere $42 profit in 1.5 years from a $10,000 investment that perfectly encapsulates the trade-off between risk and reward.

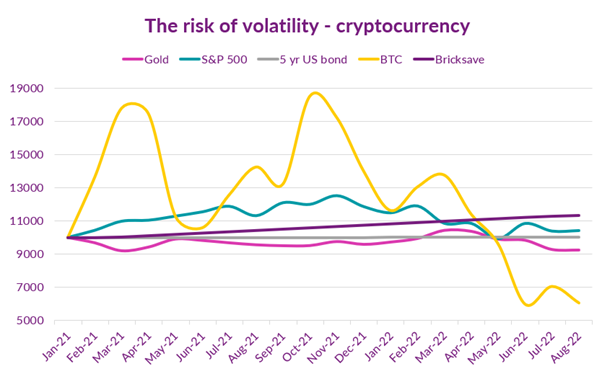

Nothing highlights the perils of volatility greater than investing in cryptocurrencies, which has created a whole new breed of multi-millionaire almost overnight. Adding an investment into Bitcoin (BTC) to the same chart above shows the gains – and losses – that can be made by the timing of investment.

In the space of just 18 months, a $10,000 investment would have been worth as much as $19,000 or, as currently, worth just $6,000. Whilst gains are potentially stellar if trades are not timed with perfection losses can be even greater – assuming you had invested $10,000 in September ’21 your portfolio would currently be worth around $4,000.

Certainly, a segment of a balanced investment portfolio can be dedicated to higher risk, higher (potentially) yielding assets. This is where money can be made fast…but it’s also where money can be lost fast, so don’t expose what you’re not prepared to risk. It’s a bad idea to concentrate on a rising super-stock, try to catch a falling knife, or chase returns that appear too good to be true.

When investing for the longer-term an investment portfolio should be spread across different assets, sectors and geographies. This spreads the exposure to risk – when one sector is not performing, profit can still be made from other investments.

Given its historical propensity for producing steady, stable income and growth, real estate should certainly constitute a sizeable portion of a balanced portfolio. Currently generating rental yields of between 8.36% and 9.03%, take a look at the whole and crowdfunded properties currently available and further diversify your investment portfolio.

Investing carries risks, including loss of capital and illiquidity. Please read our Risk Warning before investing.